Interchange, Part 2: Interchange and Other Processing Fees

You may have heard about Illinois Senator Dick Durban’s newest war on “swipe fees.” Senator Durban led a charge for the Federal Reserve to cap interchange fees on debit cards in 2010. In the dozen or so years since those regulations went into effect, some merchants (those set up on a payment pricing plan called “Interchange Plus”) all over the U.S. have paid lower fees than before to accept debit cards for payment.

In May of 2022, Senator Durban argued in front of the Senate Judiciary Committee to expand the debit card “swipe fee” cap to include the fees associated with accepting credit cards too. The merits of a regulation expansion of this kind continue to be hotly debated.

In both arguments and legislation, Senator Durban refers to these fees as “swipe fees” because it helps the general public understand what he’s referring to. After all, who (outside of the payments industry professionals who live and breathe it every day) even knows what interchange is? Well, YOU are about to also!

Interchange

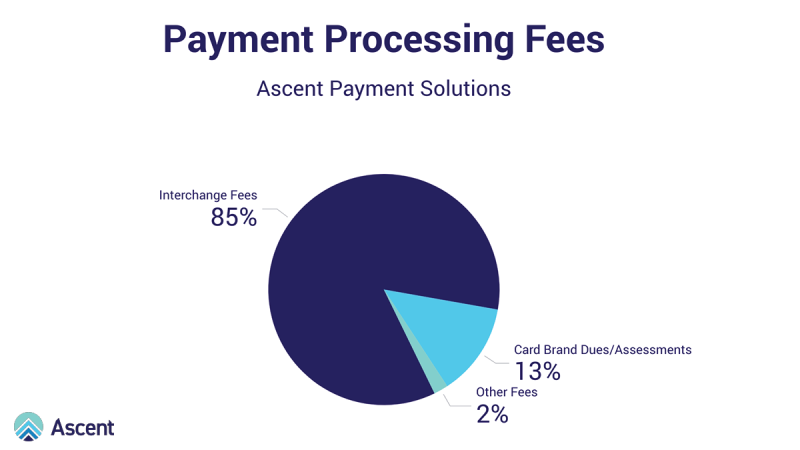

Interchange generally accounts for 85% of the total cost of accepting a credit card for payment. This fee can vary drastically based on the card brand (Visa, MC, Amex, and Discover), the type of card used (debit, standard credit, rewards, etc.), what country it was issued in, the merchant type (real estate, retail, lodging, etc.), and the technology used to process the payment, among many, many other things.

While there are over 2,000 variations of interchange fees that a merchant can pay, merchants in our industry (short term rental, long term rental, and other lodging businesses) generally see interchange categories ranging from as low as 0.05% for a regulated debit card all the way up to 3.15% for business, international, or high-reward cards.

Interchange rates are set and reviewed by the card brands on a semi-annual basis and modifications to various categories are typically rolled out in April and October. As you can imagine, most often these changes are increases, although there have been a fair number of reductions to certain categories over the years also.

100% of the interchange you pay goes directly to the bank that issued the card to your guest.

Some examples of varying interchange rates include:

- High-rewards cards are marketed to and generally used by high-wealth individuals who earn expensive rewards and other benefits like https://thepointsguy.com/guide/the-most-valuable-mastercard-world-elite-benefits/ and https://thepointsguy.com/guide/visa-signature-card-benefits/ . These cards carry higher interchange fees for two reasons:

- high net worth cardholders spend substantially more on travel, and

- providing the high value rewards costs the issuing bank significantly more than an average card.

- Issuing banks with more than $10B in assets (known as “regulated” banks) have their debit interchange fees capped (by Durbin’s 2010 amendment) at 0.05%. Those issuing banks with less than $10B in assets (known as “non-regulated” banks) are allowed to charge up to a whopping 2.95% for some debit interchange categories.

- Credit cards used in the US but issued outside of the US are generally associated with higher interchange categories. Luckily, international travelers typically outspend domestic travelers, and this does help mitigate the higher cost of acceptance.

- Purchases made in person have a lower chance of being fraudulent and the interchange assessed on these card-present transactions is lower as a result. A cardholder standing in front of you – with a physical card in their hand that includes a working chip - is statistically less likely to be using a card number that they stole or bought off the dark web.

Given the wide range of range of interchange fees that any one transaction may qualify for, it can be challenging to keep track of your payment costs. Some processors attempt to make this easier by packaging all the different rates together and billing you only one (or two, or three) different rates. While this sounds tempting, and might appear to be simpler on your monthly statement, it is generally more expensive for the merchant.

Imagine what your management company would have to charge a guest for a week’s stay at “any vacation rental home on your website.” If you offered guests a flat price for any rental under your management, you would have to charge them enough to cover your highest per-night property in case they chose that one, or risk being upside-down on your revenue. Because of this, flat rates for payment processing doesn’t work out to your advantage.

Ideally, you’ll want to be set up with “Interchange Plus” pricing by your payment processor or service provider. This pricing program ensures that the processor is passing interchange and card brand fees through to you at the rate/cost set by the card brands. With interchange rates ranging from 0.05% to 3.15%+, Interchange Plus pricing provides you with any saving available when your guest pays with a less expensive card type. Under this pricing plan, the service provider is usually paid via transparent markups called basis points .

Association Fees

Visa and MasterCard used to be Associations, with each issuing bank and each acquiring bank designated as paying members. MasterCard filed their public IPO in 2006, and Visa, never one to be left behind, filed in 2008. As a result, both companies work for their shareholders now, and they do what they can to drive their share prices up, in addition to maintaining governance and oversight over the entire credit card network.

All the card brands charge – and keep – fees when their branded cards are used. These fees are commonly labeled Card Brand Fees on your statement but can also be labeled individually (e.g., NABU, FANF, Assessments, etc.)

Card Brand Fees are charged in addition to interchange fees. Some, like Assessments, are charged on the volume of every transaction processed while others are charged only in specific circumstances (e.g., International Fees, Misuse of Auth, Digital Enablement, etc.). These fees range widely in cost to the merchant.

others are charged only in specific circumstances (e.g., International Fees, Misuse of Auth, Digital Enablement, etc.). These fees range widely in cost to the merchant.

Card Brand Fee examples:

Assessments: .14% x your credit card volume

Misuse of Auth: $0.09/eligible auth

International: 0.5% - 1% x your international volume

Authorization Fee

The network that handles the authorization requests, including the transmission and recording of the authorization data, charges a per-transaction fee for their services. This fee most often ranges from $0.10 per transaction or more, depending on your processor.

Basis Points Over Interchange

Your payment service provider coordinates the secure communication between the many different systems and entities needed for your payments system to work well (software, gateway, network, acquiring bank, issuing bank, card brands, etc.). As long as they have you set up on Interchange Plus pricing, the service provider typically charges for the complex services they provide in the form of a markup of basis points added to the interchange charged on each transaction.

A basis point is an accounting term used to describe 1/100 of 1% (also expressed as 0.0001). As an example: if your markup is set to 25 basis points, you will be assessed $0.0025 x your processing volume (in addition to interchange). This amount is typically paid to your payment service provider.

If your payment processor is not forthcoming about how they are paid or how many basis points over true interchange they are charging you, beware.

Some examples of the services a merchant receives from a reputable payment services provider:

- Negotiating the fees charged by your acquiring bank

- Rental/ lease language advisory services

- Chargeback support and advisory services

- Business type and other code assignments to ensure best interchange qualifications

- Ongoing risk mitigation advisory services

- Payment gateway integration

- PCI support and advisory services

- Technical boarding

- Technical support and transaction troubleshooting amongst all the entities

- Reporting

- Underwriting

- Industry advocacy with card brands, banks, etc.

Settlement Fee or Transaction Fee

Some processors charge merchants an additional transaction fee that can range from $.010 - $0.25 per settled transaction. That doesn’t sound like much, but it can add up. If you process 250 transactions per week, this extra fee can mean $3,200 annually from your bottom line.

Statement Fee

Acquiring banks use massive systems to keep your data – including individual interchange assessments, ACH batch totals, and all billing metrics – securely separated from all their other merchant’s data. Each month they summarize the transactions, batches, and associated billing, and provide you with reporting to aid your accounting reconciliations.

The statement fee is usually nominal, ranging from $5-$20 per month. But if you’re using a processor trying to hide their fees from you, this is a common place for them to do it.

Gateway Fees

A secure and flexible payment gateway integrated with your reservation software saves its cost multiple times over by eliminating manual and double entry on each booking. A gateway customized for the accommodation rental industry can help you verify guest identity, reduce chargebacks, accept alternative and less expensive payment types, and more.

Gateway fees can include a monthly fee, per transaction fees, batch fees, and potentially others. Sometimes the gateway fees are “free”. This can be a good deal for your business, or it could be that the gateways costs have been hidden or added to your processing costs.

Ugh, fee overload, right? In Part 3 of this series, we’ll review the 11 ways you can lower these fees and their impact on your bottom line – including ways to offset the costs of accepting guest payments altogether.

Categories

Share This Content