Net Billing or Negative Interchange can Save Merchants Significant Money

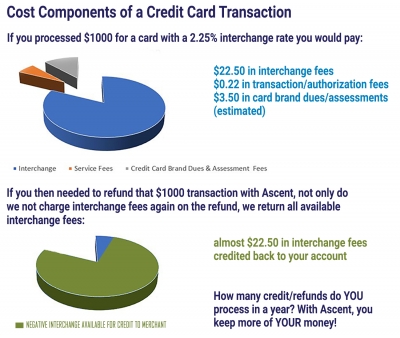

Ascent sets our merchants up on Interchange Pass Thru Pricing, which is agreed upon by Independent Sources as the most transparent and best pricing for our merchants. The advantage of interchange plus pricing is that it allows the merchant to see the real cost of each credit and debit transaction. In addition, transactions are not priced according to a tier. Instead they will each be priced out separately, which can save money. Any savings that are offered by the card brands – such as the much lower rates on debit card categories – Ascent passes on to you. Card Brands use interchange fees to determine how much you pay an issuing bank each time you accept a credit or debit card. Interchange is also used to determine how much money you get back on your processing fees when a customer returns the product or cancels a reservation already purchased.

We do set up merchants for Net Billing or Negative Interchange on refunds when available. This is another example of how Ascent passes savings to you. If the card brands offer to give any interchange back when you process a refund, we pass all of that benefit to you. Many processors keep that savings for themselves or even charge you again to process the refund. A transaction fee has to be charged on transactions in either direction. Transaction fees are fees for accessing processing networks, they are charged both directions because the processing networks are queried on charges and returns. A transaction fee has to be charged on transactions in either direction. Transaction fees are fees for accessing processing networks, they are charged both directions because the processing networks are queried on charges and returns.

We do set up merchants for Net Billing or Negative Interchange on refunds when available. This is another example of how Ascent passes savings to you. If the card brands offer to give any interchange back when you process a refund, we pass all of that benefit to you. Many processors keep that savings for themselves or even charge you again to process the refund. A transaction fee has to be charged on transactions in either direction. Transaction fees are fees for accessing processing networks, they are charged both directions because the processing networks are queried on charges and returns. A transaction fee has to be charged on transactions in either direction. Transaction fees are fees for accessing processing networks, they are charged both directions because the processing networks are queried on charges and returns.

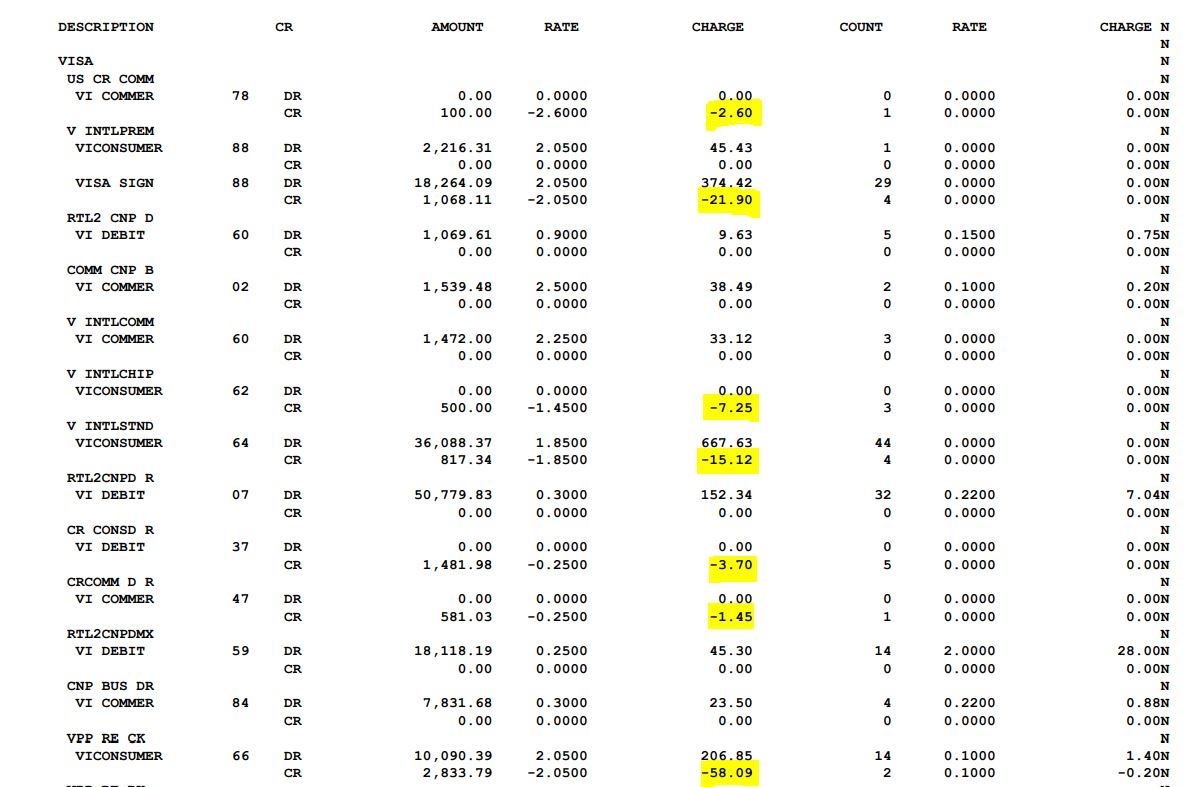

You should be able see the evidence of returned fees in the form of interchange credits on your monthly credit card processing statement. Any savings that are offered by the card brands – such as the much lower rates on debit card categories – Ascent passes on to you. Click here for more details on the benefits of Interchange Pass Thru Pricing.

See our example of how we do return the available negative interchange when available. Add up how many refunds you have processed throughout this past year, especially with all the natural disasters and the impact of COVID on cancelling reservations. If you are with Ascent, we allowed you to keep more of your money. For example, when COVID-19 hit our industry, there were massive cancellations in March and April of 2020, resulting in high volumes of refunds being processed. It was not uncommon for a merchant to have more refunds than sales during those two months. We had a merchant in Hawaii who experienced this scenario. As a result of their NET BILLING setup, the negative interchange we passed on to them outweighed their regular sales interchange, resulting in almost $10k in fee credits issued to them on their March and April volume! Even after their other fees and sales volumes were factored in, we literally put money INTO their bank account instead of debiting them for their monthly fees. We’ve credited this one merchant over $13k in interchange fees in one year.

If you know someone who is not with Ascent, refer them to us for a customized quote so we can show them the savings and service they deserve. Your referral is a reflection of our commitment to excellent customer service. Send us a vacation rental or lodging referral, and when they begin processing with Ascent, we will treat you with a check for $150.

We have been focused on the success of Vacation Rentals/Lodging for more than 20 years and will continue to help educate and inform our merchants and our industry family on tips to make it through this crisis and to come out stronger than ever on the other side. Fill in the form or reach out to info@ascentpaymentsolutions.com for more details. We are here to help.

Categories

Share This Content