Chargebacks: Lodging Card-Not-Present Fraud is on the Rise

55% of all credit card fraud in the U.S. takes place in the hospitality industry. That is a pretty big number that certainly negatively affects Ascent clients, as well as all lodging companies who manage vacation rentals, resorts, hotels, and other short-term-rental inventories. What makes matters worse, is that most of the fraud being perpetrated today is of the online or ‘card-not-present’ (CNP) variety prevalent for advance payments in our industry – which is harder to prevent. According to Javelin Strategy, “Card-Not-Present Fraud is now 81 percent more likely than point-of-sale fraud.”

Why are we seeing more online or card-not-present chargebacks/fraud?

Two simple reasons:

- The introduction of EMV chips into credit/debit cards helps dramatically reduce in-person or point-of-sale fraud.

- While it has been increasing for years, 2020 has really pushed almost every business and industry into increasing their online sales. The simple fact is, people who commit credit card fraud were not going to go away because it is harder to use a fake credit card to purchase something, they just evolved their tactics as businesses evolved.

For definitions sake, when we discuss ‘Card Not Present’, it means exactly what it sounds like – the payment was made without the card being present. This type of transaction is mostly done online but could also be done over the phone or when a tokenized card ‘on-file’ is used to pay an invoice. ‘Point of Sale’ is when a person presents the physical credit or debit card for the purchase or payment. The majority of lodging transactions are made in advance of arrival, therefore, CNP transactions.

With the increase in CNP fraud comes the inevitable increase in chargebacks. As we all know, chargebacks are not fun and even when you win, it can still cost you money (notwithstanding the internal or operational costs of responding to chargebacks). If you do end up losing a dispute, which is entirely possible where true fraud has occurred, you can lose significant monies. According to the LexisNexis Risk Solutions True Cost of Fraud, every $1 of fraud actually costs you $3.36 now in resources and fees associated with fighting a chargeback.

One of the ways to help prevent these types of chargebacks is to better understand them. With better understanding, comes the knowledge to spot possible situations where chargebacks may occur ahead of time and possibly put systems in place to assist in preventing them from occurring.

Understanding Fraud: Terms & Definitions

Understanding Fraud: Terms & Definitions

To better understand the nature of these chargebacks and what you will see more of moving forward, we want to discuss definitions for terms you might hear, chargeback codes you might see, types of fraud, and even some simple examples that show the true complexity of chargebacks.

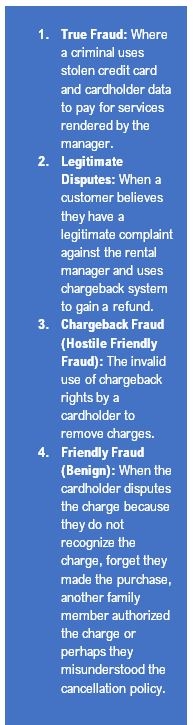

Something that everyone who deals with chargebacks should understand is that the definition of ‘fraud’ when it relates to chargebacks is probably a bit more open-ended than you think it is. For many in the processing industry, the term fraud does not just apply to bad-actors or ‘fraudsters’ who steal credit card numbers and personal information to steal products, services or money, which we can call ‘Traditional Fraud’.

The term fraud is also more broadly applied to the actual cardholder when they initiate a chargeback for services they did purchase or receive. When the actual cardholder initiates the chargeback dispute this is referred to as ‘Friendly Fraud’. To confuse that issue further, you will see sub-categories of Friendly Fraud. For example, some of these disputes are ‘Benign’ which allows for chargebacks that are initiated by the cardholder in good faith, such as not recognizing the charge, misunderstanding policy, or having a legitimate dispute. When these ‘benign’ chargebacks are submitted by the cardholder, as you will see the most likely chargeback code will fall under the classification of fraud.

‘Hostile Friendly Fraud’ is when a cardholder initiates a chargeback dispute to receive monies that they are not due. Basically, they are taking advantage of a system that favors them over the merchant (especially when the card is not present). According to Global Risk Technologies (GRT) in their examination of Friendly Fraud, “approximately 86% of chargebacks are fraudulent, and many consumers bypass merchants to directly file complaints with card-issuing banks”.

‘Card-Not Present’ Fraud/Chargeback Codes

If you are unlucky enough to be on the receiving end of a CNP Fraud chargeback, below are some of the more-likely codes that you will see associated with the dispute.

No Cardholder Authorization (4837) The cardholder states that neither he, she, nor anyone authorized by him or her engaged in the transaction.

Card Holder Does Not Recognize (4863) The cardholder claims that they do not recognize the transaction and states that they did not authorize the charge to their credit card.

Other – Card Absent Environment (10.4) Cardholder did not authorize or participate in a transaction conducted in a card-absent environment (i.e., internet, mail-order, phone-order, etc.).

Examples of Online or CNP Fraud in the Lodging Industry

Just as there are several definitions and classifications used to define fraud and related chargebacks, there are even more ways that fraud can be perpetrated on lodging entities. Here are just a few examples & types of fraud, that you should be on the lookout for:

- Contact-less Check-in (True Fraud): To make the process of checking in as easy and safe as possible for customers in the era of COVID, lodging managers may have opened the door for fraud. Some managers have used electronic locks, online apps, and texting key codes to implement digital check-in where a customer can bypass the traditional front desk check-in. While this may improve customer experience and provide a level of perceived safety, fraudsters can now use stolen credentials and have no problem at the front desk where they may need to present the physical card or ID that was used to book the stay.

- Card Testing (True Fraud): When a criminal gets a hold of stolen credit card information, it is a common practice to test the card to make sure it is still active. One all too common way to do this is to make a very small online purchase or to get an authorization to go through on the card. This is when rental managers become a target. Criminals will attempt to reserve a room for a future date to see if the card will be authorized, if it is they will move on to selling the stolen credentials or use the card to make a purchase. By the time the reserved stay comes around, the card has most likely been shut off which leaves merchants turning away actual customers. This is more prevalent in a hotel/motel/resort atmosphere where guests do not get charged until upon arrival.

- Chargeback Fraud (Hostile Friendly Fraud): This fraudulent request for a return or refund in the form of a chargeback happens when a transaction is disputed by the cardholder to regain the transaction dollar amount while retaining the product or services rendered. For lodging merchants, this is when a customer stayed at the hotel then disputes the charge to attempt to get their money back. This type of dispute is winnable for merchants by submitting a compelling dispute response.

- Failure to Cancel/No-Show (Friendly Fraud): A traveler neglects to cancel their reservation in accordance with the manager’s cancellation, but do not believe they should be responsible for the charge since they did not use the rental.

- Unsatisfactory Experience (Friendly Fraud): A traveler uses the lodging but makes a claim that they are due a refund or compensation due to a negative experience. It is important to note that the claims can be either fraudulent or legitimate. As noted above there are actors who will use the fact that credit card processes favor the cardholder to attempt to get an unwarranted refund.

- Business Name Not Recognized (Friendly Fraud): This happens when the cardholder does not recognize the charge from the business name on their statement. Generally, this happens when a business uses a corporate name for their banking, but a DBA for public-facing business. For example, the guest rented with ABC Vacation Rentals, but the credit card statement shows XYZ Associates, LLC.

- Unexpected/Unrecognized Charges (Friendly Fraud): There may be times when guests see unexpected charges on their statements (linen rentals, deposits, late check-out) that are outside of the charges they expected from their original booking and they file a chargeback. Often, these charges are valid and may have been authorized by family members or traveling party and the rental manager used the tokenized ‘card on file’. In a hotel/resort setting, it often revolves around food & beverage or gift shop purchases.

- Billing Disagreement (Friendly Fraud): If the guest feels like they have been over-charged for their accommodations based upon their understanding of the agreed upon rate. These disputes tend to revolve around taxes, resort fees or other mandatory fees that many exist outside the advertised daily rate.

- Damage Dispute (Friendly Fraud): A rental manager may charge the card-on-file for damages or stolen items during the stay. If the guest disagrees, they may dispute the charges.

- Non-Use of The Rental (Friendly Fraud): This dispute reason has certainly risen in 2020, but has existed for many years. In the past, it generally revolved around weather-related events that made the property unavailable, or in the opinion of the guest, the trip untenable due to weather or other circumstances. Generally, the reasons fall outside the cancellation policy of the lodging manager and the guests did not purchase travel insurance. In 2020, we have seen a marked increase in chargebacks that could be considered Friendly Fraud due to the COVID-19 Pandemic.

Click here for a frightening story of fraud from one of our merchants:

Be Aware. Be Prepared. Ask for Help

As you can see, fraud can take many forms and sometimes is not even willful on the perpetrator, but can result in a drain on your resources and loss of money. No one wants to deal with chargebacks, but they are inevitable at times. The key is figuring out how to proactively prevent what you can, and how to best respond to the ones you receive, since we believe the incidences of card-not-present fraud will only continue to increase.

Look for obvious signs of fraud:

- Have you received an odd number of one-night reservations in a short period of time and at an unexpected time? If so, these reservations may be attempts to test credit cards to see if they can be authorized and the reservations may be false and removing units from your inventory. Put a system in place to verify these reservations.

Put in safeguards:

- Do you have a system in place for last minute reservations to verify their identity before heading to the room or rental unit using your contact-less check-in?

- Have you verified that travelers have seen and agreed to all your policies and procedures?

Understand all the ways you are vulnerable:

- No company is immune from chargebacks or people trying to defraud them, whether it be a deliberate attempt or a more benign disagreement or misunderstanding. Review all the ways, your lodging organization may be exposed to fraud and chargebacks.

Prepare for disputes:

- Do you have internal procedures for chargebacks? Is all the necessary documentation easily accessible and in the correct format?

Ask for help:

- Before responding to a chargeback – as for help. Ascent Processing is here to help you and can review your response before you submit it. There are times where we can help you word responses in the format that credit card companies prefer, or can tell you where you need to provide more information.

If you have questions or want more information on our excellent chargeback support, fill in the form on this page or contact us at clientsuccess@ascentpaymentsolutions.com.

Categories

Share This Content