What You Need to Know About Merchant Category Codes (MCC)

Payment ProcessingGeneralInterchange

MCC De-Coded

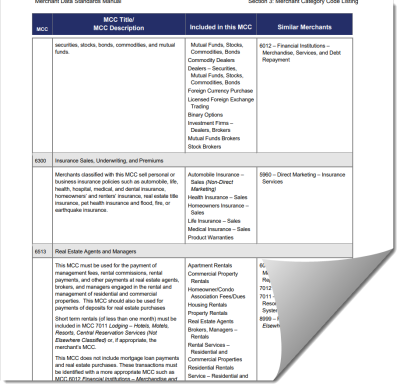

Merchant Category Code (MCC) is a four-digit number used in the payments industry to classify business by the primary type of good or service for which payments are accepted. MCC is used for a range of purposes, including activity tracking, reporting, tax purposes, and risk management.

MCC helps distinguish payment activity expected based on business type. For instance, when paying at a restaurant, the consumer adding a tip is expected, where that behavior is not expected at most retail businesses (e.g., t-shirt shop).

Because tips are expected, the card brands and banks know that restaurants, categorized as 5812 Eating Places and Restaurants, will generally settle transactions with a higher dollar amount (with tip) than the amount authorized (total due before tip). Many other businesses are required to have the settled amount match exactly with the amount authorized on the card.

A merchant’s category code is used to track and restrict activity. For instance, many business cards have certain MCCs set as restricted, to help ensure that the company card is used by employees for business purchases only. Issuing banks that offer certain types of rewards to their cardholders track the purchases made by MCC to determine which purchases qualify for rewards.

The interchange rates paid by merchants in each category are also determined by MCC. The card brands and banks assign risk levels to business industries, and interchange, which is set by the card brands, tends to be more costly for higher risk industries.

Each merchant processing account can only have one MCC assigned. If the merchant processes payments for more than one type of good or service within the same business, they can sometimes still use one Merchant ID (MID). In that case, they must be set up with the MCC that corresponds to the main business (the business with the highest sales volume). Otherwise, they need to set up more than one processing account with different MCCs assigned.

For instance, many VRPMs provide both long- and short-term rentals as part of their business. Visa requires that short-term rentals be categorized as 7011 Lodging and long-term rentals as 6513 Real Estate Rentals. In these cases, the merchant should either use one Merchant ID to take payments for both long- and short-term payments or they must have separate MIDs with separate MCCs for each type of payment. If they use one MID, the MCC assigned should correspond with the merchant’s main business.

MCC is assigned when a processing account is underwritten and approved. The card brands have final say on MCC and retain the right to require corrections to MCC assignments and use at any time.

The codes should be but are not always set consistently across the different banks and networks. Ascent can help with reviewing the MCC you are assigned to ensure you are compliant for your industry and getting the best rates possible by card type. If you have any questions, contact us at clientsuccess@ascentpaymentsolutions.com.

For more information:

MasterCard:

Visa:

https://usa.visa.com/content/dam/VCOM/download/merchants/visa-merchant-data-standards-manual.pdf

Categories

Share This Content