PartnershipsStretchBill and Ascent Payment Solutions

StretchBill

Website: StretchBill.com

Sales Inquiries: sales@stretchbill.com

Phone: 888-266-0266

New Albany, OH, USA

About StretchBill

Similiar to layaway, StretchBill's platform splits payments where the renter must pay in full before arrival or risk losing the booking. Most property managers offer a plan where renters pay in four (4) installments every two (2) weeks beginning at booking.

Property Manager Benefits:

- No credit/debit card fees on StretchBill bookings

- Avoids chargeback exposure

- Attracts new bookings

- Manages groups splitting a booking

- Online checkout button on direct booking website or email link options

- Convenience fee/surcharge or free-to-renter models

How StretchBill works:

- The renter authenticates to their bank and StretchBill verifies they are the account owner with adequate funds (minimizing both fraud and NSF risk)

- First installment is processed

- Future installments are processed using the same banking details per the StrecthBill payment schedule

- Each installment is deposited into a Stripe Connect account for the benefit of the property manager

- After all installments have processed successfully, StretchBil sends instruction to release payment to the property manager's bank account

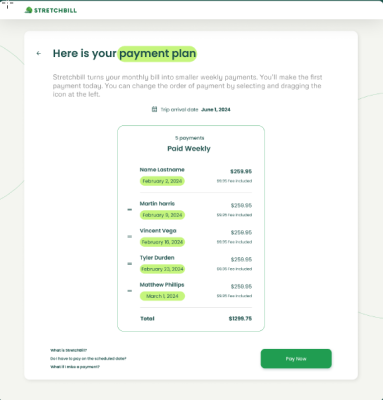

All Payments for one or one payment for All:

- StretchBill supports two (2) ways that renters can pay:

- IndividualPay: renter pays all installments as an indvidual

- GroupPay: one payment per individual, split over as many as 10 people

IndividualPay

- When the person booking wants to split his/her payment

- Property manager chooses if it is a free service to the renter or a convenience fee model

- Number of installments and intervals can be custome to the property manager

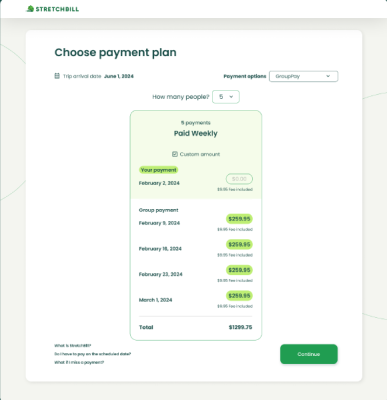

GroupPay

- For groups that want to split up the cost of a booking

- The person booking sets up each group members name/email

- each week a new group member pays

- person booking make the first payment

- Seamless way for the group to pay before arrival

Ascent’s Benefits

A few of the ways we can make your life easier by sharing some features that set us apart from other payment solution providers:

- ASCENT has specialized in credit card processing for the vacation lodging industry including the short & long-term rental markets for more than 20 years. Unlike a local bank we truly understand how your business works and offer the best rates and service with the most transparent Interchange Plus program

- Ascent offers Tenant File clients ACH/E-Check services, Credit/Debit Card Processing and more including a compliant surcharge solution through a secure virtual terminal.

- As Merchant of Record (MOR), your relationship is direct with the underwriting bank so that you have more control over your money.

- We walk you through all steps involved to get your PCI Compliance certificate providing essential security, peace of mind, and breach coverage*

- We offer full chargeback support at no additional cost

- You as the merchant are refunded your credit card fees on credits and returns that you run (Net Billing), this can add up to substantial savings over the course of the year

- ASCENT will proactively review (free of charge) what a tenant receives from you to make sure your documents are the most effective in standing up against chargebacks (eg. Confirmation, Terms and Conditions, Lease Agreements, etc.)

- No Setup Fees, No Contract Length Requirement, No Cancellation or Early Termination Fees

*partner bank may provide financial coverage if you are certified PCI compliant through their program

Share This Content